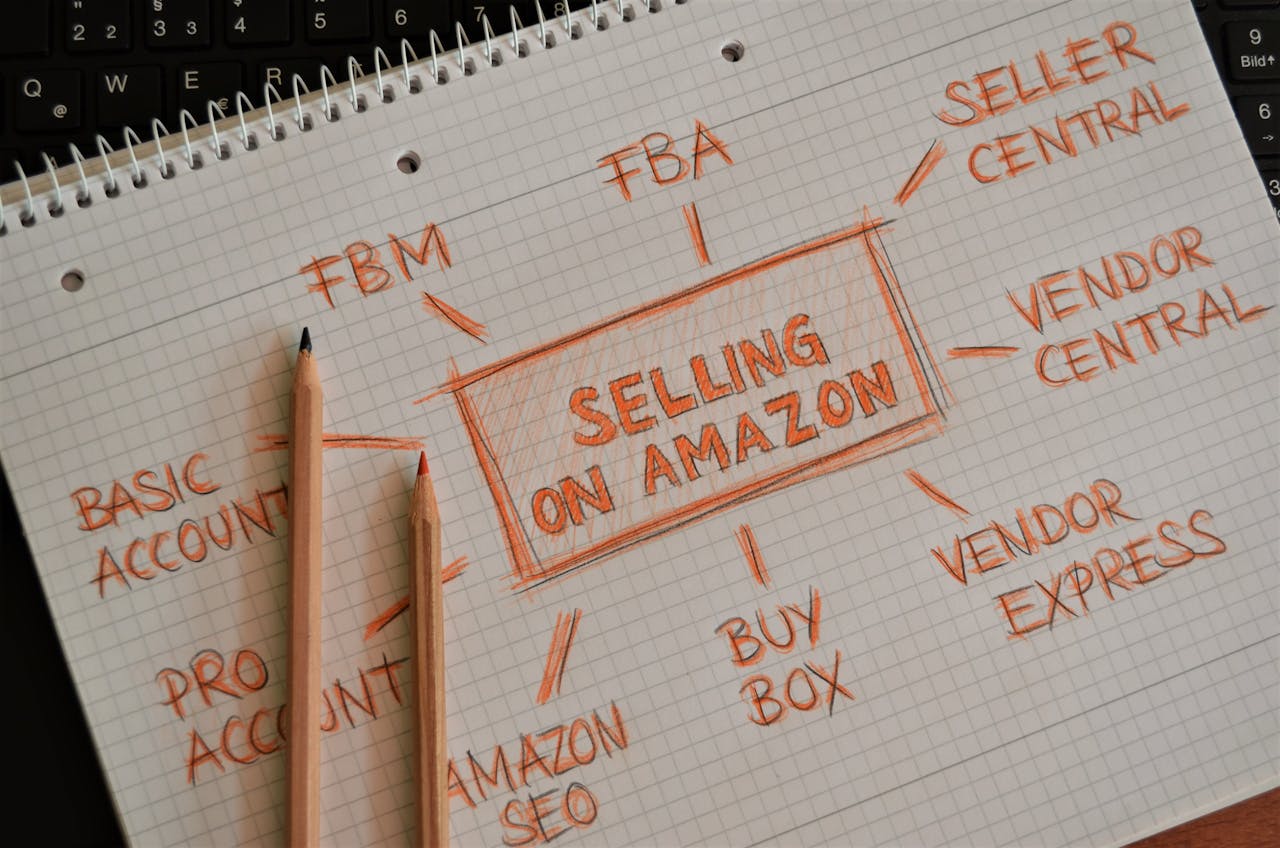

Amazon is what we call a Marketplace Facilitator, and after some recent laws were passed, they are responsible for collecting and remitting sales tax for ALL STATES.

But does this mean that Amazon FBA sellers are exempt from state sales tax?

Whilst Amazon is relieving sellers of a significant portion of the compliance burden, there are still some things Amazon FBA sellers should do to remain compliant and avoid any unpleasant surprises down the line.

What Amazon Does for You

- Calculates the correct sales tax based on the buyer’s location

- Collects that tax at checkout

- Remits the collected tax directly to the appropriate state

- Validates Sales Tax Exemption Certificates supplied by other businesses

What Do Sellers Need to Be Aware Of and Why?

Registering for Sales and Use Tax Accounts Where You Have Nexus

Some states still require your business to register for sales and use tax accounts if you have reached Sales Tax Nexus by selling on Amazon. Nexus can be triggered by:

- Storing goods in Amazon FBA warehouses or fulfillment centers

- Crossing state economic nexus thresholds

The following states have currently confirmed with RJM that you should be registered if you store goods with Amazon OR cross the state’s economic nexus threshold:

|

State |

Register if Storing Goods |

Register if Economic Nexus Reached |

|

Connecticut |

Yes |

Yes |

|

DC |

Yes |

Yes |

|

Georgia |

Yes |

Yes |

|

Kentucky |

Yes |

Yes |

|

Louisiana |

Yes |

Yes |

|

Maine |

Yes |

Yes |

|

New Jersey |

Yes |

Yes |

|

New Mexico |

Yes |

|

|

Oklahoma |

Yes |

Yes |

|

Pennsylvania |

Yes |

|

|

South Dakota |

Yes |

Note: Information is constantly changing, and we cannot guarantee this is accurate at the time you are reading.

Amazon does not have a straightforward way to determine where they are storing goods. You can pay for third-party APIs to handle this for you, OR get a free Nexus assessment by RJM to determine where you are storing your goods. To work it out yourself, follow these video instructions:

Once you download a report, you will notice all the locations are listed as abbreviations (e.g., ABQ1 = Albuquerque, NM). It’s a tedious process to work this out on your own without the help of a third party.

One of the downsides of Amazon FBA is that you have no control over where your inventory is stored. In our experience, once you send a shipment to Amazon, it gets distributed to nearly every state. Since there is currently no control for the seller, it is best to register in the states that consider physical nexus to have been reached from the outset.

Registering for Sales and Use Tax to Create a Resale Certificate

We have established that Amazon collects and remits sales tax for all orders. But what about when you purchase from a wholesaler to resell on Amazon FBA?

Most wholesalers only sell to businesses (B2B) and understand that their products are intended for resale. HOWEVER, they should still charge sales tax if the goods are shipped to a state where the buyer has nexus.

This is where your Resale Certificate comes in. It’s an official document with a valid sales and use tax number that certifies you’re buying for resale. It must be signed and typically includes information from both the vendor and the buyer.

Some states have unique certificates, while others use a multijurisdictional form. You don’t need one for every state, but you do need the right ones. Start with your business state. For example, if your LLC is located in California, apply for a California sales and use tax account and complete the resale certificate with your California number.

Some states do not accept out-of-state resale certificates:

- Alabama

- California

- Florida

- Hawaii

- Illinois

- Louisiana

- Maryland

- Massachusetts

- Washington

- Washington D.C.

If you ship inventory to these states, you’ll need a resale certificate from that specific state.

IMPORTANT: Once you register for a sales and use tax account to create a resale certificate, you must file returns for that account, even if Amazon remits the tax. States don’t know this unless you file. Failure to file can result in penalties.

COMMON MISTAKE: Some businesses skip this step if wholesalers don’t charge tax. But if wholesalers are audited, they may start enforcing tax properly, or you might have to switch suppliers. Certificates can take weeks to issue. Don’t wait and risk having to halt your orders.

Sales Tax Filing

It might sound strange that you’re responsible for filing sales tax returns when Amazon is collecting and remitting the tax. Still, once you register for a sales tax account, this becomes your responsibility.

Once registration is complete, the state will send instructions on how frequently you need to file, which may be monthly, quarterly, semi-annually, or annually. Filing on time is essential to avoid late fees and penalties.

Most states will ask you to report the total sales made on Amazon. You’ll then use a deduction column (often labeled something like “Marketplace Facilitator Sales” or “Amazon collected”) to declare that Amazon paid the sales tax, so you’re not taxed twice.

Selling on Additional Platforms

Many successful Amazon FBA sellers don’t stop there—they expand by launching their website once their brand gains traction.

This is where many sellers get caught out. While many states don’t require you to register for a sales tax account if you only sell through Amazon, that changes once you start selling through other platforms, like Shopify, WooCommerce, or even direct private invoices.

You’ll need a full sales tax nexus assessment to determine where you should be registered and ensure you’re collecting sales tax on your website sales. If you skip this step and get audited, you’ll be required to pay back all the sales tax you should have collected, plus penalties and interest. Yikes.

Many successful Amazon FBA sellers don’t stop there and instead begin selling on their website, especially if they have a well-established brand.

This is when many sellers get caught out. Whilst many states do not require you to register for a sales and use tax account if you only sell on Amazon, they will require you to register if you start selling elsewhere, such as Shopify, WooCommerce, or through private invoices.

You will need a full sales tax nexus assessment to determine where you should be registered and ensure you are collecting sales tax on your website sales. If you fail to do this and get audited, you will need to pay back all the sales tax you should have collected, along with penalties and interest.

Additional State Taxes to Be Aware Of

California

California has a state franchise tax. Businesses must pay at least $800 per year if considered to be “doing business” in the state. You are if:

- You engage in any financial transaction in CA

Note: Public Law 86-272 may exempt sellers from this if they have no physical presence and only make sales of tangible goods. - Your business is domiciled or organized in CA

- Your CA sales, property, or payroll exceed the following (2024):

|

Category |

Threshold |

|

CA Sales |

$735,019 |

|

CA Property |

$73,502 |

|

CA Payroll |

$73,502 |

So, suppose a business reaches the California sales threshold or stores more than $ 73,000 in Amazon FBA warehouses in California. In that case, it will be required to register and pay the Annual Franchise tax fee.

California has a deal with Amazon to get seller information. If you start selling in 2025, expect a letter around 2029. The penalties are steep, so be aware of your obligations early.

Texas

Texas also has a Franchise Tax. If you make a sale in TX (which will happen quickly), you must register. For 2024–2025, businesses under $2.47 million owe no tax, but must still file Form 105-02 (public info report).

Washington

Washington has a Business & Occupation (B&O) Tax. It’s based on gross receipts, not profit. If you have a nexus in WA (and storing FBA inventory counts), you must register.

- Retailers pay 0.471% of gross receipts.

- Small business credits may be available, making it relatively low-cost to maintain.

Summary

It’s a mistake to assume Amazon is handling everything when it comes to taxes. There’s still a lot to consider. Taxes can be daunting and confusing, and it’s essential to have someone in your corner.

RJM can handle everything mentioned in this blog—from resale certificates to multi-state registrations and filings. Whether you need a little help or a complete compliance strategy, contact us. We’ve got your back.